Insurance Reports

Benefits Drones Bring…

- Streamlined Claims Process

- Rapid Disaster Response

- Extensive Underwriting Data

- Depreciation Reporting

- Fraud Prevention

- Efficient Roof Inspections

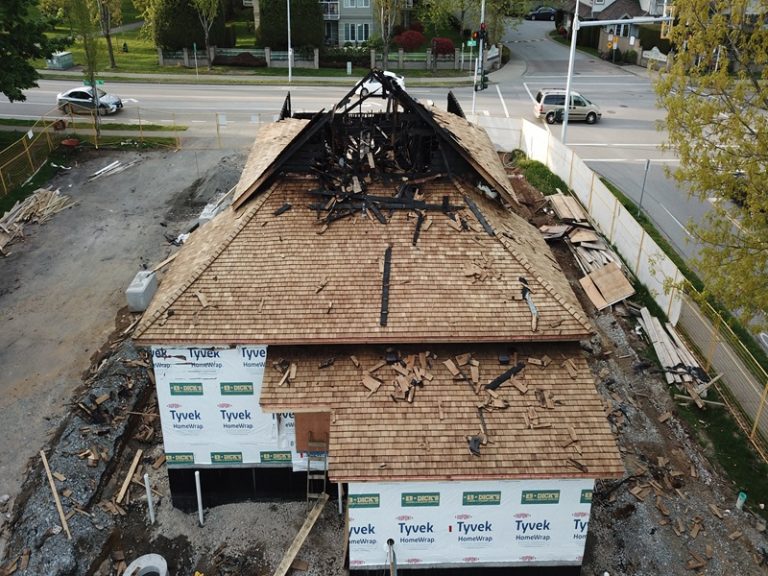

Fraud Prevention

Drones contribute to fraud prevention by providing objective and detailed documentation.

In cases of suspected arson for example, drones are used to safely capture high-resolution images that can assist investigators in analyzing the fire’s origin and validating the legitimacy of claims.

In all cases these high resolution images and videos provide a baseline to be used for comparison purposes in the event of a potentially fraudulent claim the future.

Rapid Disaster Response

Drones enhance the efficiency of natural disaster response efforts by rapidly surveying large areas. Most recently, after the BNSF train collision near the Delta Watershed Park, drones were used to assess the initial damage and then monitor the extensive clean up efforts afterwards.

During the 2023 wildfire season in the interior of British Columbia, drones were extensively deployed to assess the extent and path of the fires while they were burning. This allowed firefighters to identify and track on areas that were in need of urgent attention.

The end result is that drone imagery quickly allows insurance companies to prioritize their response efforts more effectively and efficiently.

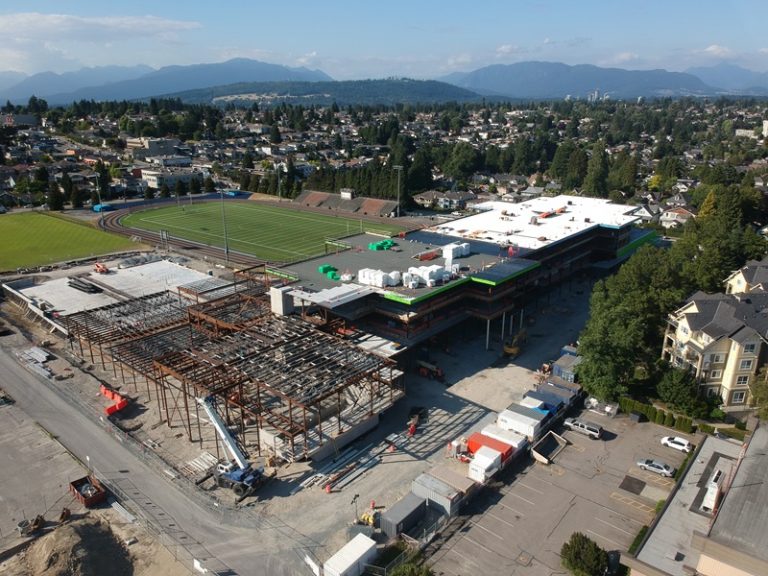

Extensive Underwriting Data

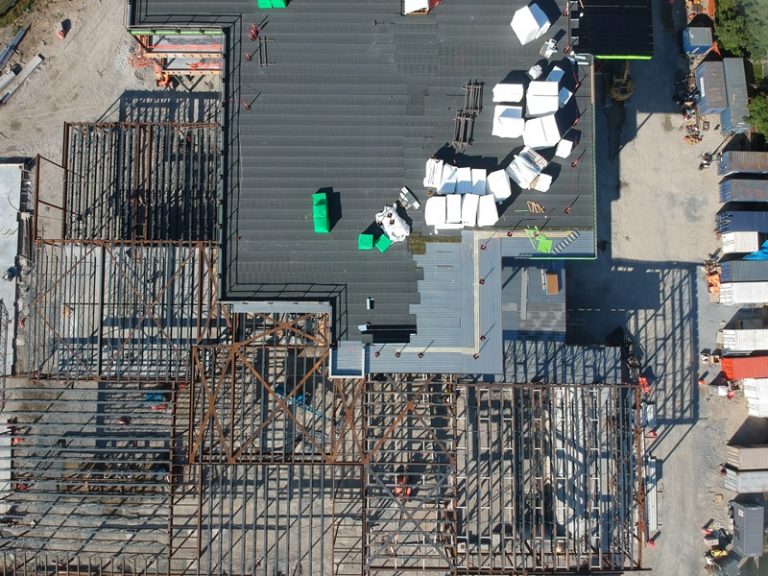

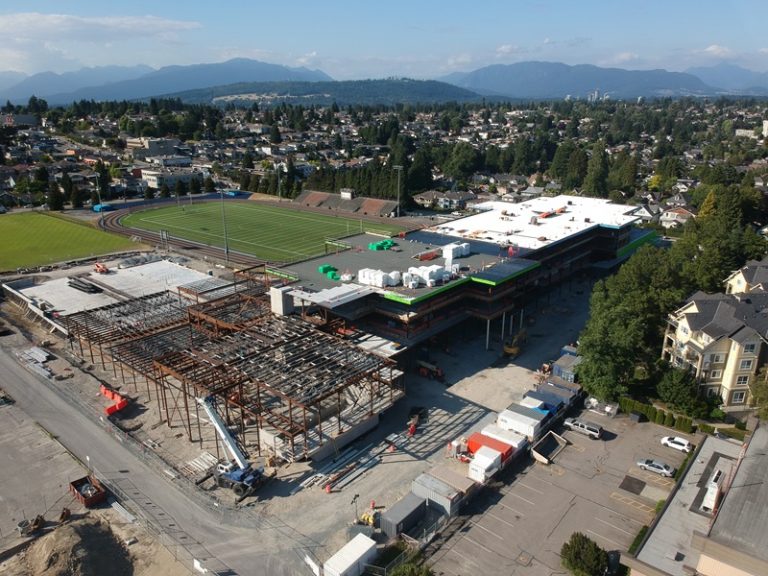

Drones provide insurers with a wealth of information for making more informed underwriting decisions. In new construction, drones can consistently capture accurate detailed images over the life of the project.

These images help commercial insurers assess the progress of the project, its completeness, and ongoing potential risks allowing them to accurately set their coverage accordingly. When gathering shots for depreciation reports in the future, these images will also serve as the basis for comparison.

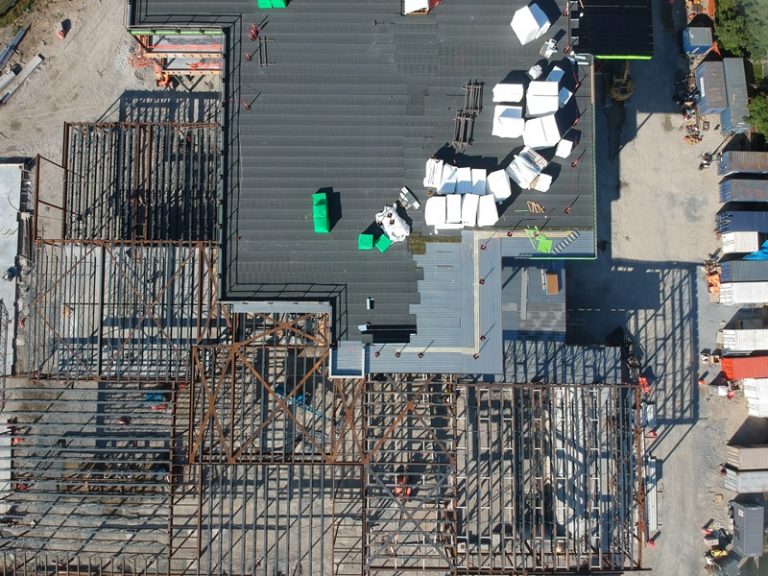

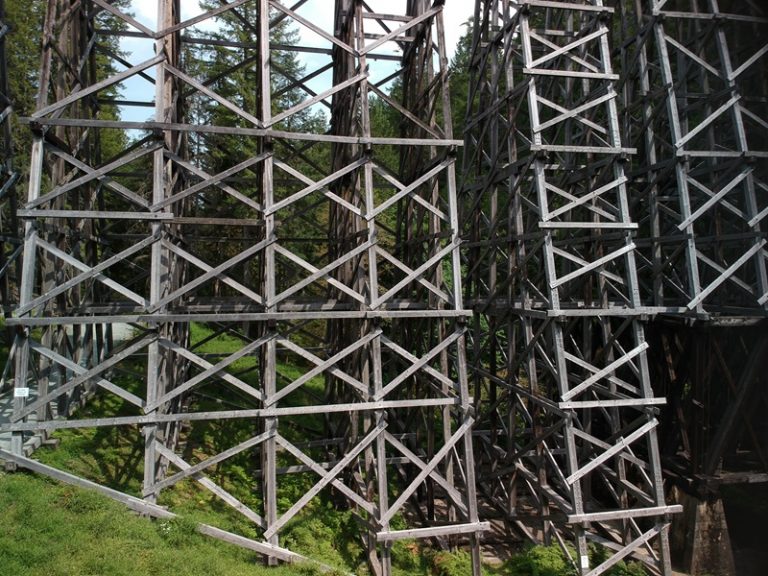

Depreciation Reports

Drones provide insurers with a more comprehensive understanding of the risks associated with their properties. In practice, drones are being used to regularly inspect properties and infrastructure both during and well after construction.

In doing so they are able to accurately identify current and potential vulnerabilities and anomalies to be included in the annual depreciation reports.

This allowing insurers to make more informed decisions about their ongoing coverages over the entire life of the property.

Efficient Rooftop Inspections

Drones can improve the safety and efficiency of your roof inspections through rapid, high-resolution imaging. Equipped with advanced sensors, they expedite assessments, reducing time and manpower requirements.

This efficiency not only speeds up the inspection process, but also ensures you get accurate and comprehensive information. Insurance companies benefit by processing claims faster, get increased cost savings, and receive more accurate risk assessments for their clients.

Drones are revolutionizing the insurance industry by expediting claims with faster, more accurate assessments, and at the same time reducing costs for insurers. Your customers benefit from quicker and more comprehensive settlements, reduced inspection times, and a better overall experience.